...the reason fewer people are paying federal income taxes is that more people are making low incomes.

Monday, April 30, 2012

Sunday, April 29, 2012

Both George Will and Paul Krugman are right about the retirement/social insurance problem

I watched the economic panel on This Week with George Stephanopolous this morning. Toward the end, both Will and Krugman made salient points about Social Security. Will pointed out that increased life expectancies have produced longer average payout periods for Social Security to beneficiaries. Krugman pointed out that the more affluent half of the country has seen life expectancy rise far more rapidly than the lower half. Will used the former statistics to argue for raising the retirement age. Krugman used the latter statistics to argue that raising the retirement age would be regressive policy.

At minimum, all this suggests that one "fix" to Social Security (which actually needs less fixing than a lot of other things, but never mind that for now) would be to lift the cap on incomes that pay into the retirement portion of FICA. But I can't help but think there is something to what Will says about life expectancy--I really see no reason why people with cushy jobs and long life expectancies shouldn't retire at a later age. I am just not sure how one creates a retirement policy that links retirement age to lifetime income without creating some really weird incentives effects.

At minimum, all this suggests that one "fix" to Social Security (which actually needs less fixing than a lot of other things, but never mind that for now) would be to lift the cap on incomes that pay into the retirement portion of FICA. But I can't help but think there is something to what Will says about life expectancy--I really see no reason why people with cushy jobs and long life expectancies shouldn't retire at a later age. I am just not sure how one creates a retirement policy that links retirement age to lifetime income without creating some really weird incentives effects.

Wednesday, April 25, 2012

The National Association of Realtors misrepresents how many people use the Mortgage Interest Deduction

An NAR Spokesperson says:

NAR is in the business of representing its members, who benefit from the mortgage interest deduction. But they still need to get their facts right.

(For data on number of returns with deductions, go to the SOI site, scroll down to "Individual Income Tax Returns with Itemized Deductions: Sources of Income, Adjustments, Itemized Deductions by Type, Exemptions, and Tax Items," choose 2009, and look at column CA in Table 2.1).

“NAR is actively engaged to ensure that the nation’s 75 million homeowners will continue to receive this important benefit, and we will remain vigilant in opposing any plan that modifies or excludes the deductibility of mortgage interest.”The problem is that not all homeowners use the mortgage interest deduction. Those without debt don't use it. Those who don't itemize don't use it. According to the US Treasury Department, in 2009, only about 37 million households took the mortgage interest deduction.

NAR is in the business of representing its members, who benefit from the mortgage interest deduction. But they still need to get their facts right.

(For data on number of returns with deductions, go to the SOI site, scroll down to "Individual Income Tax Returns with Itemized Deductions: Sources of Income, Adjustments, Itemized Deductions by Type, Exemptions, and Tax Items," choose 2009, and look at column CA in Table 2.1).

Sunday, April 22, 2012

Has the Variable Rate Mortgage saved the European Mortgage Market?

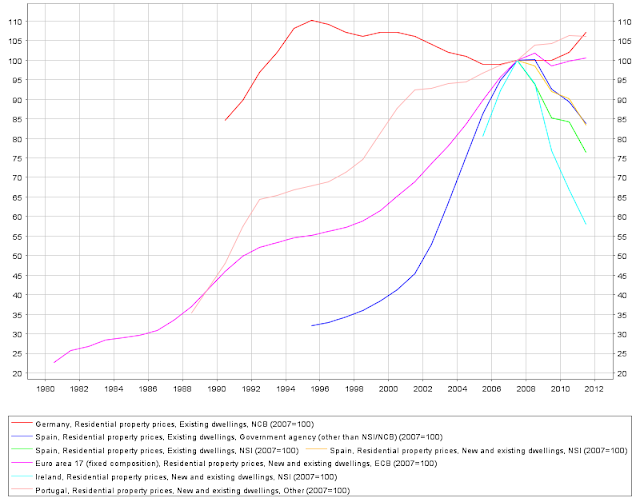

Just as in the United States, many European countries have had large run-ups and crashes in house

prices. Consider the data from the European Central Bank below: one sees in particular large price increases and declines in Spain and Ireland.

Remarkably, default rates in Ireland and Spain in 2009, while high by historical standards at 3.6 and 2.9 percent respectively, were substantially lower than in the United States, where the default rate was 13 percent (see Fiorante and Mortgage Bankers Association of America). Dwight Jaffee has argued that this difference in performance is the result of the fact that mortgages in Europe give lenders recourse to the borrower. I find it plausible that recourse matters, but not that it matters quite so much. For example, while purchase money loans in California are non-recourse, refinance loans are not. The preponderance of mortgages in California are refinance loans, and California's default rate is extraordinarily high.

So why haven't borrowers in Spain and Ireland defaulted more? According to the European Mortgage Federation, more than 80 percent of loans in Spain and Ireland are variable rate mortgages. As a consequence, as market interest rates fell, so too did mortgage interest rates. The typical mortgage borrower in Ireland and Spain is currently paying considerable less than 4 percent on their mortgage.

This has almost certainly been beneficial to Europeans, and suggests that robust TARP 2 program, where underwater borrowers can refinance their loans at lower interest rates, could help mitigate default. On the other hand, as interest rates rise in Europe, we might have reason to become very, very concerned about defaults there in the months to come.

Saturday, April 21, 2012

Monday, April 16, 2012

I like Romney's "secret" policy plan of the day.

Cutting back tax deductions (and especially the deduction for second homes) for the affluent? What a good idea!

Friday, April 13, 2012

Thomas Phillipon asks why financial services are so expensive (h/t Tim Noah)

An abstract:

Despite its fast computers and credit derivatives, the current financial system does not seem better at transferring funds from savers to borrowers than the financial system of 1910.

Phillipon notes that while finance has grown rapidly as a share of GDP, stock prices have become no more informative of future cash flows, and risk sharing has not improved. But as Paul Volker might say, at least we have the ATM now.

Thursday, April 12, 2012

Mixed feelings about falling e-book prices

Amazon's cutting of e-book prices is a good thing for consumers. But...

Here in Pasadena, there survive independent bricks and mortar book (Vroman's) and music (Canterbury's) stores. It is great to have them around, because browsing is fun. I spend more than I have to for books and cds because I want them to stick around (sort of like public radio, I guess).

Nevertheless, I have a Kindle, and I buy stuff from Amazon too, because of (1) convenience and (2) inventory. Vroman's is great, but it can't stock everything. When I want to read something, given the choice between waiting for a special order or waiting for some electrons to arrive, I will take the electrons. When I travel, I find that electrons are lot lighter than books too.

Hence it is not price that drives my purchasing decisions, but I am enough of an economist to know that prices drive the decisions of most others. If that price gap between Amazon and Vroman's grows even larger, I am not sure how Vroman's survives. Pasadena without Vroman's is not quite as nice a place as Pasadena with Vroman's.

Here in Pasadena, there survive independent bricks and mortar book (Vroman's) and music (Canterbury's) stores. It is great to have them around, because browsing is fun. I spend more than I have to for books and cds because I want them to stick around (sort of like public radio, I guess).

Nevertheless, I have a Kindle, and I buy stuff from Amazon too, because of (1) convenience and (2) inventory. Vroman's is great, but it can't stock everything. When I want to read something, given the choice between waiting for a special order or waiting for some electrons to arrive, I will take the electrons. When I travel, I find that electrons are lot lighter than books too.

Hence it is not price that drives my purchasing decisions, but I am enough of an economist to know that prices drive the decisions of most others. If that price gap between Amazon and Vroman's grows even larger, I am not sure how Vroman's survives. Pasadena without Vroman's is not quite as nice a place as Pasadena with Vroman's.

Tuesday, April 10, 2012

How apartment rents and vacancies can rise (or fall) simultaneously

We at the Lusk Center put out the Casden Forecast for apartment economics in Southern California every spring. When we put out our San Diego numbers last week, we presented a result that confused people--we expect both rents and vacancies to rise in the next year.

The reason this can (and often does) happen is that real estate markets operate with lags, and feature "natural" rates of vacancy. The "natural" rate is the rate at which real rents stay constant--if vacancies fall below the natural rate, real rents rise; if they rise above, rents fall. Stuart Gabriel and Frank Nothaft did a nice paper on this some time ago.

Consider a tinker toy model of rents that is characterized by two equations (the ts in parentheses are subscripts for time):

Of course, this is all in real terms. When there is inflation, nominal rents can rise even when the vacancy rate is above the natural rate, because rising nominal rents are masking real falling rents.

The reason this can (and often does) happen is that real estate markets operate with lags, and feature "natural" rates of vacancy. The "natural" rate is the rate at which real rents stay constant--if vacancies fall below the natural rate, real rents rise; if they rise above, rents fall. Stuart Gabriel and Frank Nothaft did a nice paper on this some time ago.

Consider a tinker toy model of rents that is characterized by two equations (the ts in parentheses are subscripts for time):

Vac(t) = Vac(t-1)+(Rent(t-1)-1)*.05

and

Rent(t) = Rent(t-1)-(Vac(t-1)-.05)*Rent(t-1)

So when rents fall below $1, absorption picks up, otherwise it falls; the natural vacancy rate (the rate at which real rents rise or fall) is 5 percent. This produces the following picture of rents and vacancies:

As one can see, this simple model shows periods where rents and vacancies rise and fall together.

Wednesday, April 4, 2012

When government is the solution

Having spent the past month in a country where one always has to be careful about what one eats and drinks, I have a renewed appreciation of first rate sewer and water systems. Such things require

governments.

I can imagine, however, that there are people of a certain stripe would would argue that clean water and good public health should no more be fundamental rights than, say, broccoli.

governments.

I can imagine, however, that there are people of a certain stripe would would argue that clean water and good public health should no more be fundamental rights than, say, broccoli.

Subscribe to:

Posts (Atom)